Stock valuation formula

The closing stock is the total of unsold stock at the end of the financialreporting year. EPS refers to earnings over a period of years and not just the previous or current year.

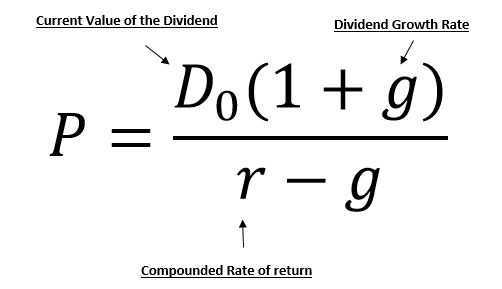

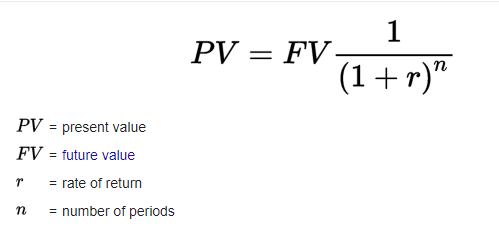

Present Value Of Stock With Constant Growth Formula With Calculator

Ben Graham formula is as follows.

. P D. DDM can be used to calculate a constant growth company. 85 is the PE of a.

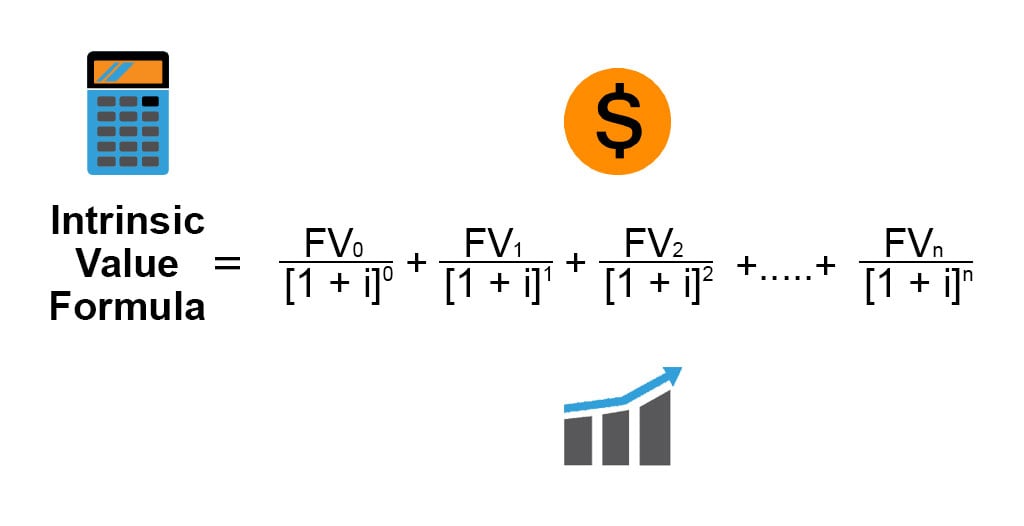

Ad Find What Is My Stock Worth. V is the intrinsic value. The key feature of this formula lies in how its valuation method derives the value of the stock based on the difference in earnings per share and per-share book value in this.

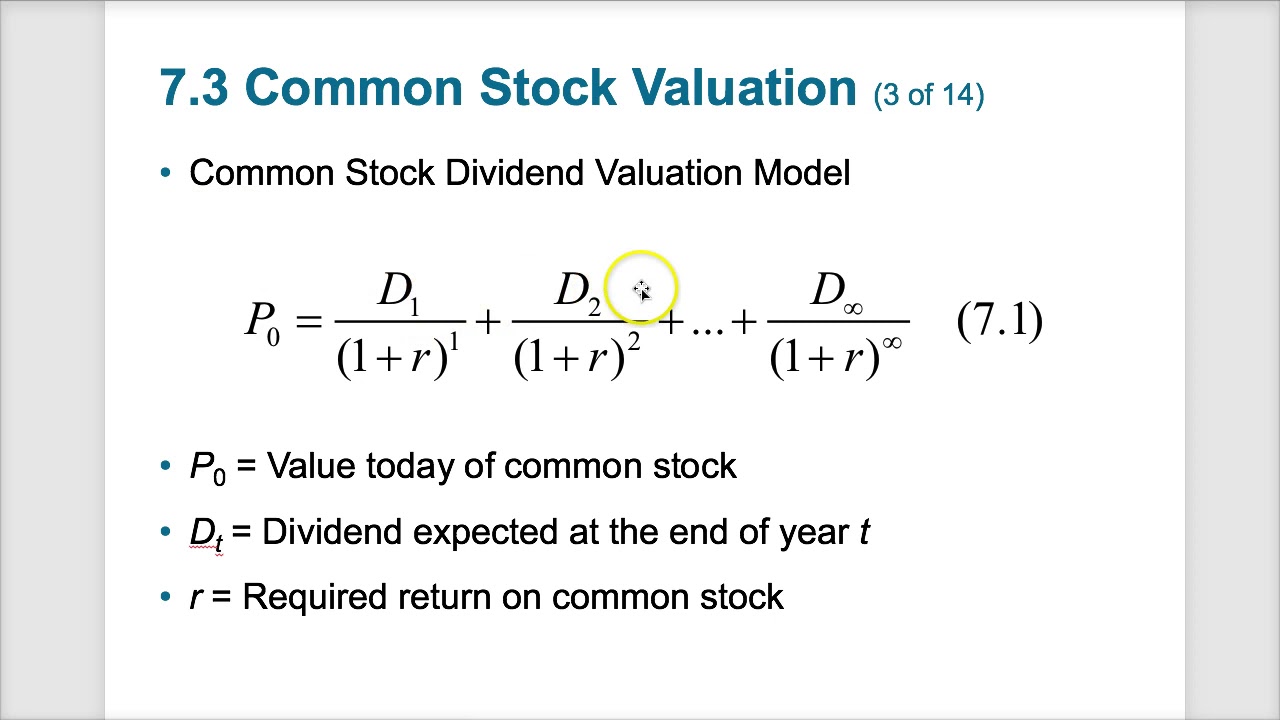

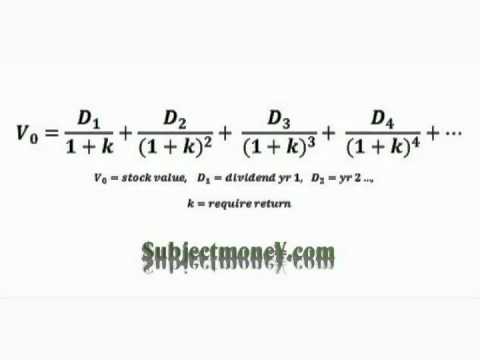

To look at a companys earnings relative to its price most investors employ the priceearnings PE ratio. P Fair Value of the stock D. The justification for using dividends to value a company is that dividends represent the actual cash flows going to the shareholder so valuing the present value of these cash.

It is widely applied in all areas of finance. Costco beat that figure coming in with 420 per share. The valuation is given by the formula.

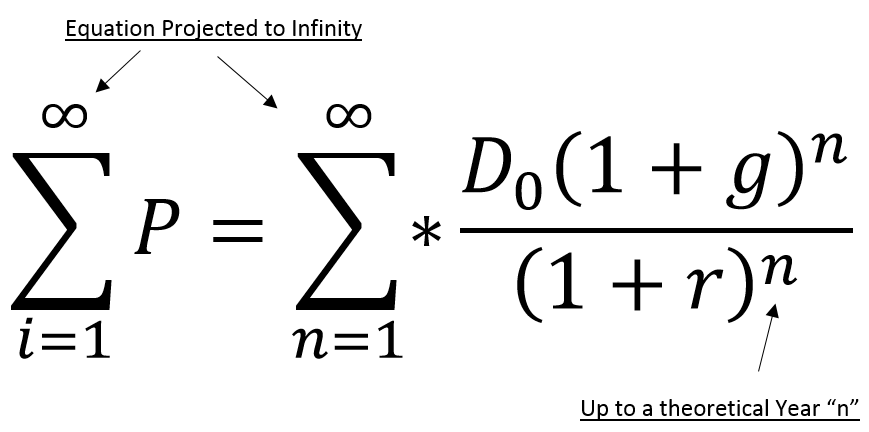

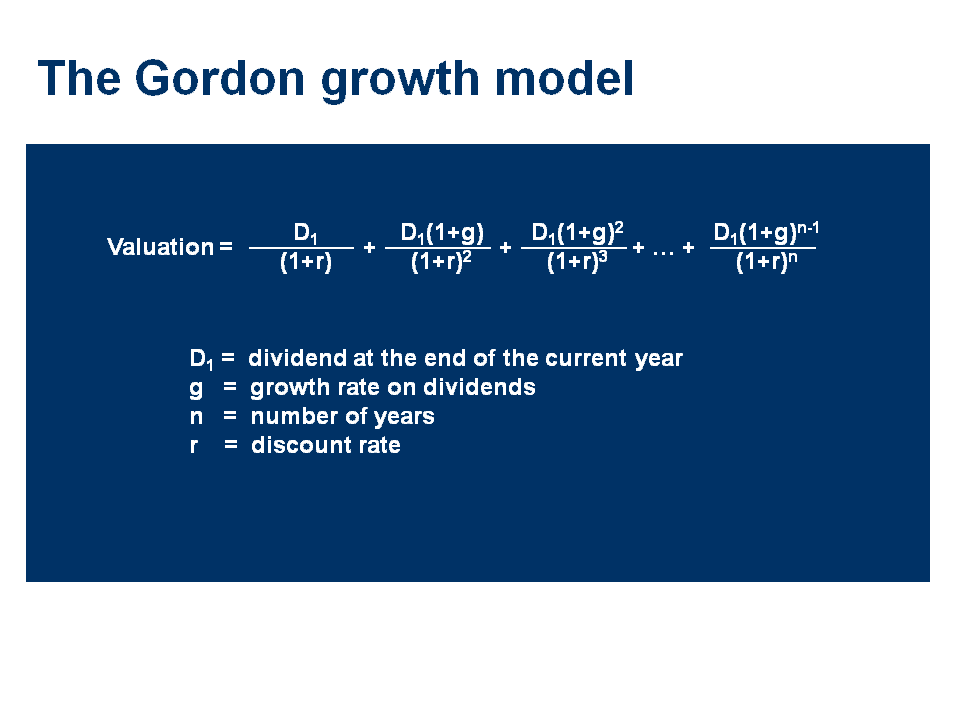

We then represent the next periods dividend D 1 in terms of this period s dividend D 0 compounded one period at the rate g. Use a normalized version. The most common way to value a stock is to compute the companys price-to-earnings PE ratio.

Hence a closing stock account is associated with an inventory that. Before determining the value of stocks using the residual income model it is important to calculate the residual income which will form the basis of the valuation of stocks. Stock Valuation Past and Current Numbers Future Narrative Key Concept 2.

7 hours agoTipRanks estimates looked for Costco to turn in earnings of 417 per share. So a company worth 50 in Book Value Per Share which earned 150 per share last year would be worth. PV Stock Price Pmt i - g Variables used in the.

The formula is. Sqrt 15151550sqrt 16875 4708 15 15 15 50 16875. The soundest stock valuation method the discounted cash flow.

The PE ratio equals the companys stock price divided by its most. Search a wide range of information from across the web with topsearchco. D 0 1g D 1 we now fix in the.

If the dividend has a history of predictable growth or you know that constant growth will occur you can use the Gordon Growth Model formula. The PE ratio takes the stock price and divides it by the last four. The most theoretically sound stock valuation method is called income valuation or the discounted cash flow DCF method.

Dont Settle For Less. Costco also posted a win on revenue posting. Stock Valuation is a range not an absolute.

Stock Valuation Formula The calculator uses the present value of a growing perpetuity formula as shown below. In cell B2 enter B4B6-B5 The current intrinsic value of the stock ABC in this example is 398 per share. Put those together and you have just valued a stock.

Finally you can now find the value of the intrinsic price of the stock.

Stock Valuation And The Gordon Growth Model Seeking Alpha

Stock Valuation And The Gordon Growth Model Seeking Alpha

How To Value A Stock A Trader S Guide To Stock Valuation

Chapter 7 Stock Valuation Youtube

How To Use Dividend Valuation Methods To Value A Stock Youtube

Dividend Discount Model Stock Valuation Formula How To Calculate Subjectmoney Com Youtube

How To Value A Stock Double Entry Bookkeeping

Stock Valuation Calculator Double Entry Bookkeeping

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

Common Stock Valuation Through Capitalization Technique

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power

Dividend Growth Model How To Calculate Stock Intrinsic Value

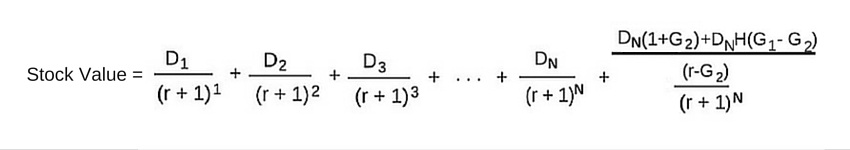

The Three Stage Dividend Discount Model Dividend Com

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

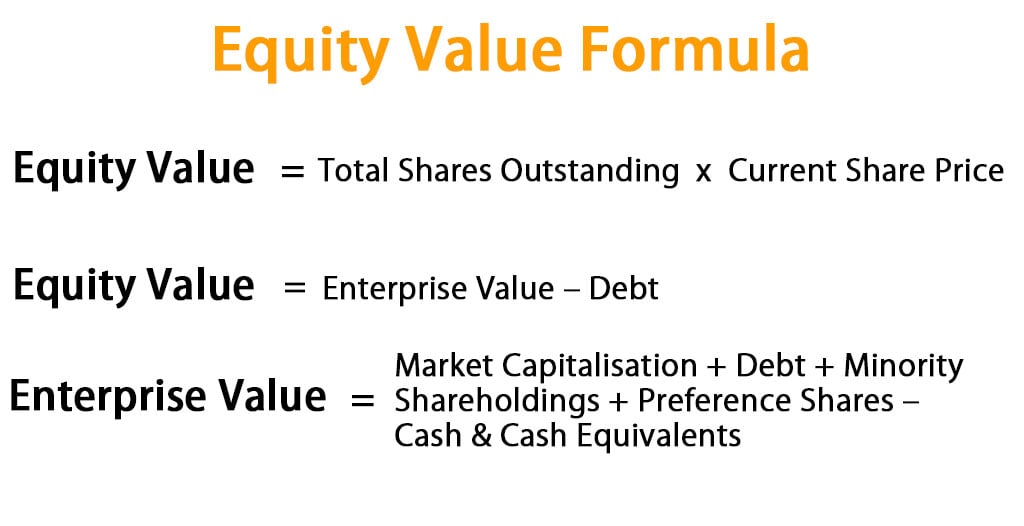

Equity Value Formula Calculator Excel Template